Mergers & Aquisitions 2021 - new record year

M&A is the abbreviation for mergers and acquisitions. It is the name for a process in which companies are brought together. M&A refers to corporate transactions such as company acquisitions, sales, and mergers. The reasons for a merger are many and varied, e.g. a better competitive position, greater market power, or synergy effects. However, it is often the case that a company becomes the target of an acquisition because it is particularly successful. In this case, one speaks of an acquisition.

M&A transactions 2021 higher than ever before

The uncertainty that prevailed at the beginning of the COVID crisis brought the M&A market to almost a complete standstill in the first half of 2020, but that was no longer the case in 2021. Rapid M&A activity in 2021 was fueled by strong demand for technology as well as digital and data-driven assets. Also, pent-up demand for deals from 2020 was unloaded in 2021. Many transactions that were scheduled for 2020 were delayed by the pandemic and completed in 2021. Companies restructured to build resilience, reduce costs, and strategically reposition themselves for future growth.

M&A deals: indicative numbers as of 2021

- In 2021, there were more than a record-breaking 63,000 M&A transactions announced or completed worldwide.

- In terms of deal value, global M&A activity was also at a maximum. In 2021, the value of global deals amounted to almost six trillion US dollars.

- In the United States, the 2021 total M&A value reached US$ 2.6 trillion, twice the value of 2020.

There has also been a lot of movement in the M&A sector in the European region in recent years. The second quarter of 2021 in particular saw a surge in activity. This resulted in an announced transaction value of around US$1,422 billion in 2021. This almost doubled the transaction value of 2020. In 2021, there were approximately 3,000 transactions with German participation. Germany's two largest private real estate groups, Vonovia and Deutsche Wohnen, reached a transaction volume of almost US$30 billion in their third merger attempt in 2021, according to media reports. In the Asia-Pacific region, the announced transaction value in 2021 amounted to US$1,260 billion.

Source: © Statista 2022

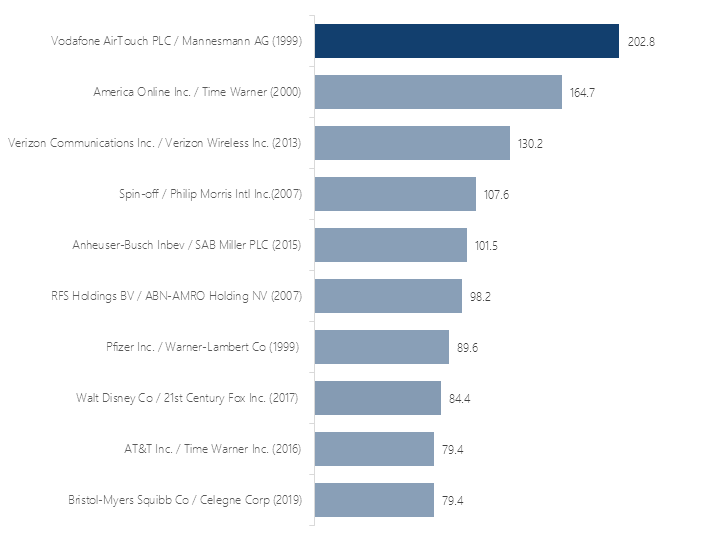

Take a look at the largest merger & acquisition transactions worldwide. When Britain’s Vodafone AirTouch PLC acquired German industrial conglomerate Mannesmann AG, the cross-border transaction was the largest merger in history. A distinctive aspect of the deal was the fact that it represented the unsolicited acquisition of a German company, something unprecedented at the time.

The most common reasons for M&A failures, with examples

M&A is a frequent business transaction. However, frequency does not correlate with success. According to Harvard Business Review, only two out of three corporate takeovers succeed. Overall, the failure rate over the past ten years has been at least 50 percent. Companies must face many challenges during a merger or acquisition. However, these often only become apparent once the deal has closed.

Reasons why M&A deals fail:

- Purchase purely based on opportunity

- Misjudgement of the true success factors

- Resources for integration fully or excessively utilized

- The buying company pays to high a price

- External factors such as a poor economic situation

- Poor post-merger integration process

Example: America Online and Time Warner (2001) - USD §99 billion loss

The Time Warner and American Online transaction was the second largest M&A deal ever. The transaction value amounted to $165 billion. An empire combining old and new media emerged. The executives behind this transaction were in a hurry to get into new media without really understanding the dynamics of the new media landscape.

That lack of understanding led to them paying too much money. Hoped-for synergy effects were never realized. Also, the corporate cultures did not match. In 2002, the company posted a loss of $99 billion.

Eight years after the transaction, the price of Time-Warner stock had fallen by more than 80 percent and the merger was reversed.

Example: Quaker Oats and Snapple (1994) - USD $1.4 billion loss

Quaker Oats acquired beverage manufacturer Snapple in 1994. The transaction value amounted to US$1.7 billion. Quaker Oats began a large-scale marketing offensive to market the beverages across the USA, placing them on shelves everywhere. But the strategy failed.

Strategists overlooked the fact that Snapple had been successful precisely because of its suburban culture yet Quaker Oats completely squandered that advantage. The acquiring management changed Snapple’’s advertising, and the different cultures led to a disastrous marketing campaign for Snapple, supported by managers who were not attuned to its brand sensitivity. Snapple’s previously popular ads were diluted with inappropriate marketing signals.

Twenty-seven months later, Snapple was resold at a loss of US$1.4 billion.

M&A outlook 2022: what is next?

According to experts, the trends point primarily in the direction of digitization and sustainability.

Digitization has accelerated since 2020 and brought its many advantages to light. With regard to sustainability, investors will place an ever-greater focus on environmental, social, and governance objectives. In any transaction, executives should be prepared to conduct ESG due diligence.

The technology, healthcare, or e-commerce sectors are very popular.

The market is increasingly focused on a few industries. For example, traditional industrial or financial services companies may buy a technology company to digitize their business and future-proof it.

Merger and acquisition activity will continue to increase in 2022.

At least, that is what more than 350 US corporate executives said in a new 2021 year-end M&A survey by KPMG. Only 7 percent of executives in the KPMG survey expect deal volume in their industry to decline in 2022. However, this estimate should be taken with a grain of salt, given ongoing global instability since February 2022, especially in Eastern Europe.

A rebranding process in M&A is inevitable for many companies and presents many challenges. What to consider in a new corporate design is a question we asked in an interview with K16, one of the leading communication agencies in Germany.

How empower® helps you face the challenges of a rebranding, you can find out on our solutions page or contact us directly.

You May Also Like

Related articles

Your own colors in PowerPoint: master color theme and custom colors

Microsoft 365 Copilot report: PowerPoint